The number of homes for sale is paltry, mortgage rates remain relatively high and prices are steeper than ever. Understandably, many Americans are discouraged with the housing market, according to NerdWallet’s 2025 Home Buyer Report, the ninth of its kind. Still, an ambitious share of Americans are ushering in the new year with optimistic plans to buy a home.

Last year is likely to be the most lackluster in around 30 years for home sales, according to data from the National Association of Realtors. Capturing what this environment means for current homeowners and hopeful home buyers can provide insight into where the market is headed next. In this nationally representative survey of 2,099 adults, commissioned by NerdWallet and conducted online by The Harris Poll in late 2024, we found 69% of Americans say the housing market has never been worse for buyers than it is right now.

“Mortgage rates and home prices have gone up a lot in the last three years, and that terrible combination has discouraged people who want to buy homes,” according to NerdWallet mortgages expert Holden Lewis. “The biggest problem is that not enough homes are for sale. The low inventory pushes prices upward as buyers compete with one another.”

Despite these tough times, 15% of Americans say they plan to purchase a home in the next 12 months (as of November 2024; referenced as “prospective buyers” throughout this report). This illustrates both the pent-up demand brought on by difficult conditions of the past few years and continued optimism among prospective buyers.

Key Findings

Pent-up demand during a tough market may lead to 2025 hopefulness. More Americans (15% of them) say they plan to buy in the next 12 months than in previous years, and they hope to spend $259,088 on average — well under the national median sales price.

Many homebuying hopefuls are taking action, but it may not be enough. More than half (54%) of prospective buyers say they’ve begun looking at homes on listing apps, but just 35% have started a down payment fund.

Last year was a tough one for would-be buyers. Just 28% of Americans who began 2024 with the intention of buying were successful at the time of our survey. Home prices were the most common reason would-be 2024 buyers fell short — 18% of them say they couldn’t afford the homes that were available.

Obstacles to buying are different for nonhomeowners and homeowners. Among nonhomeowners, the top factor preventing them from buying a home right now is that the cost of living has gotten too high (35%). For current homeowners, the most common roadblock for buying a new home is high mortgage rates (23%).

The market is tough, and pressure is high. Nearly seven in 10 Americans (69%) say the housing market has never been worse for buyers than it is right now, and 54% of Americans say there is too much pressure to own a home in the U.S.

Prospective buyers illustrate pent-up demand

Every year, our annual Home Buyer Report signals optimism in the share of people hoping to buy homes. But this year marks the highest share of Americans (15%) planning to buy since we began asking in 2019 — 9% said they planned to buy in that year’s report, 10% in the 2022 study and 11% each in the 2020, 2021 and 2023 studies. Zealous would-be buyers are likely encouraged by the start of a new year — think of all of the ultimately unfulfilled resolutions that are set at this time. This confidence could also be attributed, at least in part, to the sustained hopes of would-be buyers who’ve been discouraged over the past few years.

Unfortunately, some of this year’s homebuying hopefuls are likely to be let down. Nearly one-in-six (15%) adult Americans equates to about 39 million people. But since 2020, around 4.9 million existing homes have been sold each year, on average.

Optimism extends to anticipated budgets

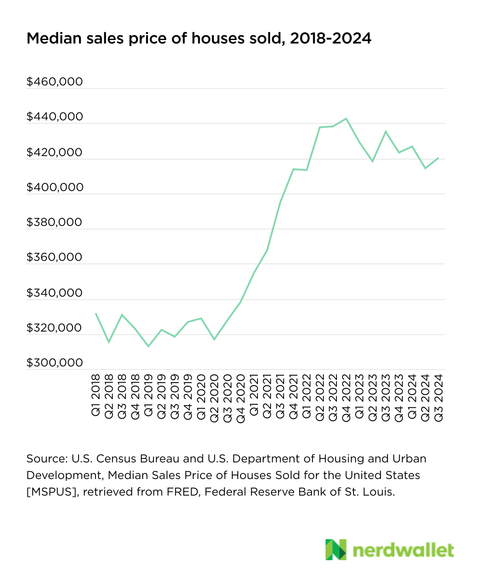

Prospective buyers hope to spend about $259,088, on average (median = $150,000), according to the survey. This at a time when the actual median sales price is about $420,000, according to data from the U.S. Census Bureau. Prices are up 32% from the similar period pre-pandemic, according to census data, and are holding steady there due to a lack of supply in the face of high demand.

“Half of buyers will spend more than $420,000 for a house, but many would like to spend much less than that,” says Lewis. “Potential buyers must balance their expectations with a realistic budget, if the primary goal is becoming a homeowner.”

Home buyer tip: Get real about your expectations. Understanding the market where you’d like to buy is a crucial step to take before you begin home shopping. Real estate apps on your phone can provide an overview, but a local real estate professional will help determine if your budget is realistic given your target location and home wish list. Be prepared to be flexible. In a market with a limited number of homes for sale, buyers willing to compromise are often those who end up successful.

Only some are making progress toward their goal

Nearly all prospective buyers (96%) say they’ve taken at least one step in the planning process. However, the actions they’re taking may not be enough: While more than half (54%) have begun looking at homes on listing apps (the most common action taken by prospective buyers), just 35% have started working on their down payment fund.

“Looking at homes on real estate apps is one of the most exciting parts of home shopping, but buying a home involves a long checklist, and some of those tasks are not-so-fun chores,” according to Lewis.

Home buyer tip: When preparing to buy a home, saving for a down payment is arguably one of the most time-consuming aspects. Many people build a down payment fund over the course of several years. A down payment calculator can illustrate the impact of a larger chunk of savings. While low-down-payment mortgages and down payment assistance programs are available under certain situations, there is little downside to saving more. Ultimately, the more you’re able to put down, the less you’ll need to borrow and the lower your monthly payments will be.

2024 proved difficult for would-be buyers

Many of those hoping to buy in the coming year may be hold-overs from 2024 or even before. Home prices have risen dramatically, and mortgage rates have more than doubled since three years ago. As such, just 28% of Americans who say they began 2024 (on January 1) with the intention of buying were successful — defined as having purchased a home or being in the process of doing so at the time of our survey.

Home buyer tip: If your plans to purchase are delayed, use that additional time wisely. Amassing a larger down payment and working on your credit are two things within your control, and both can result in a more affordable mortgage. Keeping your credit utilization low and making all of your payments on time can translate to lower mortgage rates when it comes time to borrow.

Current roadblocks to buying, for nonhomeowners and owners

More than one-third (35%) of nonhomeowners say that the high cost of living is preventing them from buying a home right now. In addition to higher home prices, prices across many regular expenses have grown considerably over the past five years, and a period of high inflation can continue to impact household budgets even after that price growth has slowed.

Current homeowners may have a lot of equity in their homes, and many are paying relatively little interest on their current mortgage. These factors make the decision to sell a complex one, even when owners have outgrown their current homes. More than six in 10 (62%) current homeowners indicate something is preventing them from purchasing their next home at this time. Mortgage rates, cited by 23% of current homeowners, and high cost of living (22%) are the top obstacles among this group. If and when those challenges are resolved, we can expect inventory to improve — a welcome sight for potential buyers.

Many are discouraged about the market and homeownership

Roughly seven in 10 Americans (69%) say the housing market has never been worse for buyers than it is right now, according to the survey. Current conditions — lack of inventory, high prices and high interest rates — are no doubt contributing to this gloomy sentiment. For younger buyers in particular, the market has never been so tough. And it’s largely younger buyers who feel the mounting pressure to buy a home as they settle into adulthood.

There is a tension between the pressure to own a home and the reality of the market. In fact, 54% of Americans say there is too much pressure to own a home in the U.S. This feeling is held by 63% of Gen. Z (ages 18-27), 61% of millennials (ages 28-43), 50% of Gen. X (ages 44-59) and 47% of baby boomers (ages 60-78).

Home buyer tip: Many people believe buying a home is a rite of passage — a necessary step into adulthood. But if you feel differently, or if the pressure to own is causing you stress, be easy on yourself. Take some time to reflect on what owning a home means to you and whether the long-term goal is worth the effort. You may find renting fits your lifestyle better, and accepting that could be a major relief. On the other hand, the reflective period could provide renewed vigor in your pursuit of homeownership.

Looking forward through 2025

“What happens to the housing market this year will be dictated by two things: interest rates and the supply of homes for sale,” says Lewis. “The two are closely linked when it comes to existing homes — when rates fall, more homes come on the market — but rates also affect home construction. It will take both an increase in existing homes for sale and new homes being built to provide relief, and that’s likely to take more than a single year.”

Home buyer tip: The Federal Reserve is planning to cut rates slowly and methodically throughout the year, barring any changes to the direction of inflation or labor market strength. Mortgage rates are also likely to come down subtly. The difference in interest paid on a 30-year mortgage when the rate is just a half percentage point lower can be significant — even hundreds of dollars per month. Bookmark a mortgage calculator: This can be an invaluable tool as prospective buyers weigh the costs and benefits of entering the market throughout the year.